From the article, “Henry II’s Campaign against the Welsh in 1165” by Paul Latimer

The Pipe Rolls, which are limited as a source in being primarily concerned with the financial interests of the exchequer, reveal four origins of resources for the campaign of 1165:

i) expenditure allowed against the sheriff’s farm or against other debts on the rolls;

ii) aids from boroughs, cities, moneyers, etc.;

iii) scutage on the servitia debita of some fiefs, lay and ecclesiastical;

iv) financial assessments on individuals, lay and ecclesiastical, concerning serjeants raised for the campaign.

It is this last set of entries which is clearly related to the agreements made at Northampton in October 1164.

The Pipe Rolls allow us to reach an imperfect estimate, in financial terms, of the resources raised for, and devoted to, the campaign. Identifying as campaign expenditure monies allowed against the sheriffs’ farms or against other debts on the rolls is a problem. There were expenses associated with the movement of the king and his retinue, whether he was on campaign or not. Where 25s. was allowed against the farm of the borough of Gloucestershire pro corredio Regis portando ad Wirecestriam et ad Salopesberiam in 1164-65, it would be wrong to treat it as extraordinary expenditure, even though it was clearly associated with the king’s presence on the Welsh border. Yet as £100 was allowed against a series of debts in Northamptonshire ad opus familia Regis it seems likely that the familia Regis was unusually swollen, perhaps with household knights.[1] Similarly, the purchases of food or even the repair and garrisoning of castles cannot automatically be associated with the campaign. Any estimate of campaign expenditure on the rolls must therefore be treated with caution. According to my calculations, around £900 was almost certainly campaign expenditure and in all as much as £1,500 was probably associated with the campaign. The aids from the boroughs, etc., the scutage and the other assessments for knights and serjeants are more easily quantified.

The Pipe Rolls do not tell us everything. The lack of any records of the royal chamber may hide money raised for, or spent on, the campaign. Also, it would not be surprising if the king had raised loans to meet some of his campaign expenditure. Only incidentally do the rolls give us any information on personal service performed with the king’s host or in the king’s castles. But even from what the Pipe Rolls tell us, we can say that the campaign of 1165 probably cost in excess of £7,500, a very substantial sum by any measure.

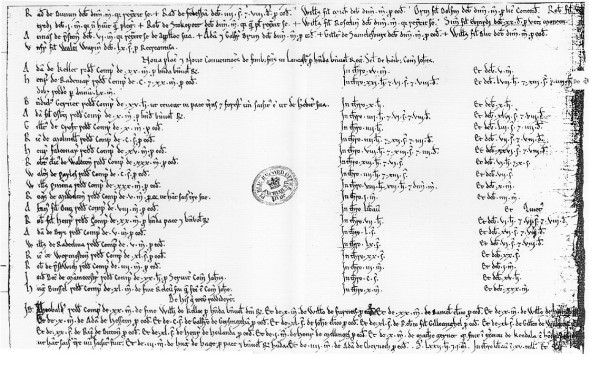

|

Table I |

Account for on PR 1164-65 |

paid* 1164-65 |

Paid before 1168-69 |

Pardoned before 1168-69 |

|

Aid of Boroughs, moneyers, etc. |

£1263 |

£1186 |

£1230 |

£11 |

|

Scutage |

£1607 |

£1134 |

£1199 |

£368 |

|

Assessments for sergjeants and knights |

£3360 |

£2309 |

£2379 |

£880 |

|

Totals |

£6230 |

£4629 |

£4808 |

£1259 |

*Payments include expenditure allowed against debts

The tenancies-in-chief, lay and ecclesiastical, assessed for scutage in 1165 were charged on the basis of one mark (13s. 4d.) per knight’s fee. In many cases the number of knight’s fees assessed can be identified with the servitia debita of the tenancies.[2] Among these, Gilbert Foliot, bishop of London, was exceptional in that he was assessed for scutage on his servitium debitum of twenty knights, and also for a separate sum de promissione servientibus.[3] In many other cases, the number of fees assessed cannot be compared with the servitia debita because the latter are unknown to us, but there are examples where the number of fees assessed differed from known servitia debita.[4] The archibishopric of Canterbury, in royal custody since Becket’s disgrace in 1164, was assessed for £113 de militibus de Archiepiscopatu de 2 exercitibus. This amounts to a double charge on 844 knights’ fees, a low estimate of the archbishopric’s total enfeoffment, but in excess of the servitium debitum of 60 knights.[5]

It was J. H. Round who first clearly identified a separate group of assessments on the 1164-65 Pipe Roll, distinct from the scutage assessments, based on a unit of 15s. 3d. and related to the promises made at Northampton in October 1164.[6] These assessments concerned a great variety of multiples of the 15s. 3d. unit (1-6, 10, 15, 20, 22, 30, 40, 50, 100, 140, 200, 300).[7] Round noted that the usual pay for a serjeant at this time was Id. per day and that therefore 15s. 3d. “would represent six month’s pay (for a year of 366 days)”.[8] It is worth examining this suggestion in some detail as it is crucial to an understanding of the units of assessment of this levy.

There is support for Round’s 1d. per day rate of pay for serjeants on the Pipe Rolls of the 1160s, where in some entries both the number of serjeants and the number of days are stated. In 1161-62 £30 6s. 8d. was allowed against the sheriff’s farm in Kent in liberatione 20 servientum de toto anno.[9] This works out at a wage rate of 1d. per day, reckoned on a year of 364 days. In the following year’s Pipe Roll under the same county, a payment of £14 6s. 8d. was allowed for twenty serjeants over a period of 172 days (20 x 1d. x 172 = 3440d. = £14 6s. 8d.).[10] In 1166-67 payment at the same rate was made for two serjeants over 176 days (2 x 1d. x 176 = 3524. = £1 9s. 4d.).[11] In 1167-68 the payments for 40 serjeants for 29 weeks and for 20 serjeants for 23 weeks were £33 16s. 8d. and £13 8s. 4d. respectively (40 x 1d. x 29 x 7 = 8120d. = £33 16s. 8d. ; 20 x 1 d. x 23 x 7 = 3220d. = £ 13 8s. 4d.) .[12]

We can be fairly certain that the 15s. 3d. unit concerned the pay of one serjeant only. If the unit were to represent the pay of two serjeants it would have to cover a period of 91½ days, which seems unlikely. It is just possible that 15s. 3d. may represent the pay of three serjeants for one-sixth of a 366-day year, that is, 61 days, but this too is improbable. In the case of the bishop of Hereford’s assessment for the 1165 campaign, the charge was for £76 5s. – 100 of the 15s. 3d. units. This entry specifically refers to 100 serjeants.[13] We can therefore agree with Round that 15s. 3d. was the ‘pecuniary equivalent’ of one serjeant for 183 days, or half a year.

J. H. Round noted only one unit of assessment among the proffers of serjeants for 1165. This was a mistake. Conan, earl of Richmond, for example, accounted for £227 10s.[14] This assessment was not based on a servitium debitum, nor was it a multiple of the 15s. 3d. unit. T. K. Keefe has identified this assessment and a number of other assessments made in 1165 as multiples of a 15s. 2d. unit (300 x 15s. 2d. = £227 10s.), but could see no reason for this `subtle adjustment’.[15] It is possible to regard the 15s. 2d., like the 15s. 3d. unit, as representing the money equivalent of a serjeant employed for half a year, the only difference being that the 15s. 3d. unit reckoned on a 366-day year and the 15s. 2d. unit reckoned on a 364-day year. There are, however, reasons for questioning this interpretation.

In only one case among the proffers for serjeants and knights does the Pipe Roll entry record the period concerned. Hugh, earl of Norfolk accounted for £227 10s. – the same as the earl of Richmond – de militibus et servientibus exercitus Walie de quarta parti anni.[16] Keefe seems to treat the three-month period as a probable maximum length of service for all the serjeants raised and financed in 1165, but this ignores the implications of Round’s work on the 15s. 3d. unit.[17] Ninety-one days was the best estimate of a quarter of a year in terms of a whole number of days. A serjeant’s pay at 1d. per day for 91 days would amount to 91d. or 7s. 7d.. This rather than 15s. 2d. was the alternative unit of assessment.[18] As Keefe correctly noted, most of the assessments involving the 7s. 7d. unit were in Yorkshire and Northumberland.[19] There is a possible explanation for this. If we can suppose some connection between the county under which the assessments were recorded and the districts where the serjeants themselves were levied, it would not be unreasonable for serjeants levied in areas most distant from Wales to be contracted for shorter periods of service. It would not be stretching things too far to include the earl of Norfolk in this category.

The earl of Norfolk’s assessment specified de militibus et servientibus rather than serjeants alone. How this arrangement might work is suggested by the Pipe Roll entry for Richard, earl of Pembroke. He accounted for £76 5s. (100 x 15s. 3d.), but was pardoned the whole amount propter 20 milites et 40 servientes quos duxit in exercitu cum Regis.[20] If the serjeants were paid 1d. per day for 183 days and the milites served for the same period, the latter would have been paid at 3d. per day. There are two plausible objections to this. First, half a year was greatly in excess of the usual forty days or six-weeks knight-service period. Secondly, 3d. per day seems low compared to the usual 8d. per day for knights in the 1160s. In answering these objections, it is necessary to bear in mind that the entry for the earl of Norfolk suggests that both serjeants and milites served for the same quarta parti anni. Though less than half a year, this was still in excess of the usual knight-service term. We are not concerned here with the commuting of customary obligations and pay rates may have differed in differing circumstances. It is also possible that the milites in these entries represented some kind of mounted serjeant rather than a full knight.[21]

The Pipe Roll entry relating to the earl of Pembroke’s assessment raises the question of the meaning of some other pardons of assessment. In the case of the earl of Pembroke, the meaning is explicit: he was pardoned on account of the serjeants and milites he had led in the king’s host. Among the scutage assessments and borough aid assessments, the meaning of the pardons and deductions is sometimes equally explicit. The honor of Peverel of London was charged £34 6s. 8d. (51½ marks). Of this, £13 6s. 8d. was accounted for by five militibus euntibus in exercitum.[22] This was enough to pay these five knights 8d. per day for eighty days. The honor of Lancaster was pardoned ten marks for ten militibus qui fuerunt in exercitu cum rege.[23] This was a reduction in the honor’s assessment at the bare rate of the scutage itself – one mark per fee. At 8d. per day, ten marks would support the ten knights for a mere twenty days. A deduction of £38 was made from the assessment of the archbishopric of Canterbury for 19 militibus euntibus in exercitum. This was enough to support the nineteen knights at 8d. per day for sixty days.[24] Less clear is the entry for the city of London. The city was pardoned 68s. from its aid for eight servientibus Regis.[25] This sum does not relate to either the 15s. 3d. unit or the 7s. 7d. unit, but at Id. per day would support the eight serjeants for 102 days.

Most pardons from the scutage and the serjeanty assessments did not refer explicitly to knights or serjeants. However, where pardons referred to specific sub-tenants of a tenancy-in-chief, there is the possibility that they were in respect of personal service performed by those sub-tenants. For example, in Devon Robert fitz Regis accounted for 100 marks de militibus. £61 13s. 4d. was paid and the rest was pardoned to individuals: £1 13s. 4d. to Robert fitz Bernard, 6s. 8d. to William fitz John and £3 to Hugh de Ra:ega. It is interesting that these pardons relate to the whole and fractional fees held by the sub‑tenants and not to any number of actual knights on campaign. This is what we should expect. Knight-service in the king’s host merited an exemption from scutage, but was not itself related to precise enfeoffments. There was no servitium debitum for sub-tenants in relation to the king, but the concept was the same.[26]

Pardons referring to individual sub-tenants also occur in some of the assessments for serjeants based on the 15s. 3d. and 7s. 7d. units. For example, out of the £76 5s. accounted for by the bishop of Bath (100 x 15s. 3d.), £1 13s. 4d. was pardoned to Henry fitz William fitz John and El 13s. 4d. to Robert Bucherel.[27] It is noteworthy that these pardons were in terms of marks and fractions of marks, even though the bishop of Bath’s assessment was not scutage.

The exchequer made a close identification between serjeants and the money needed for their pay. In the cases of Radulf de Salcei and Hugh de Buckland, their assessments and the pardons of their assessments were expressed in terms of serjeants and not in terms of money.[28] It is always possible in cases where a money assessment related to a service due or promised that a pardon of that assessment reflected the performance of that service, even where this is not stated explicitly.

Henry II’s intention to concentrate on the levying of foot soldiers for the campaign against the Welsh is reflected in the fact that 67.6 per cent of the total assessments against tenancies-in-chief were based on the 15s. 3d. and 7s. 7d. units, rather than on the 13s. 4d. (one mark) unit of the scutage. The serjeanty assessments were on average considerably heavier than the scutage assessments. I have calculated that the money-value of the serjeanty assessments against tenancies-in-chief was on average 3.57 times the amount that would have been charged against the same tenancies if they had been assessed for scutage at one mark per fee.[29] If we look at the amounts paid on the serjeanty assessments and scutage assessments during the five years from 1164-65 to 1168-69, rather than the initial assessments, the picture alters only slightly. In this period 74.6 per cent of the scutage assessments and 70.8 per cent of the serjeanty assessments were paid. J. H. Round described the serjeanty assessments as ‘arbitrary’.[30] There was certainly no fixed relationship between the number of serjeanty units and the number of knights’ fees on the tenancies concerned, but the two were still quite closely correlated. The serjeanty assessments, in a rough and ready way, did take into account the ability to pay.[31]

Ecclesiastical tenancies-in-chief were particularly heavily hit. Most of them were assessed for serjeants rather than for scutage, and for both in the case of the bishop of London. Although the assessments on the Church accounted for only 13.4 per cent of the total scutage assessments, they accounted for 48.5 per cent of the serjeanty assessments by value and for 55.4 per cent of the payments on these assessments in the first five years. Even where Church tenancies-in-chief were not assessed for serjeants, they did not necessarily escape lightly. We have already seen that the archbishopric of Canterbury was assessed for two scutages, and the bishop of Durham was assessed for 100 marks de dono suo, an amount that was far in excess even of a scutage on the see’s total enfeoffment.[32] In the context of the king’s dispute with Becket and of the desire and need of the other bishops to appease the king, it is understandable that the Church’s assessments were so high.

There is some regional variation in the impact of the levy in all its forms. The counties bordering Wales were particularly lightly assessed. For Cheshire and the earl of Chester’s palatinate earldom there is no Pipe Roll record, but even in Shropshire and Staffordshire no tenancies-in-chief were assessed, and in Gloucestershire and Herefordshire there were relatively few assessments. It seems likely that this regional imbalance reflects the amount of personal service performed by the knights of the border counties.

The raising of money by a levy specifically designed to finance large numbers of foot soldiers for a campaign was a novel and effective experiment. The ‘arbitrary’ dona levied from ecclesiastical tenants-in-chief for the Toulouse campaign in 1159 had been on a much more restricted scale, had been in addition to scutage rather than an alternative, and had only the general purpose of raising money for the campaign. The 1165 experiment, with its 15s. 3d. and 7s. 7d. units of assessment, does not seem to have been repeated by Henry II, though in 1172, for the levy to finance the Irish campaign, some tenants-in-chief were exempted from scutage because they had sent money not accounted for on the Pipe Rolls. Other expedients for raising additional money for campaigns were used by Richard I and John.[33]

The money paid on the serjeanty assessment in the first year of the 1164‑65 levy (£2,309 – 68.7 per cent of the assessments) would alone have been sufficient to pay over 3,000 serjeants for six months. This was in addition to the money used out of normal revenues, the money from scutage, from the dona of the towns, and any personal knight-service performed. Although the serjeanty assessments were generally heavy, particularly so on the Church, there seems to have been no complaint. The king had asked for help at Northampton in October 1164 and the baronage responded. The Church may have had its own special reasons for cooperating, and many of the lay baronage had a personal or family interest in the defence of the lands of the Normans in Wales, but we should not dismiss the power of a general obligation to king and feudal lord.[34]

[smartads]

1. PR 11 Henry II, pp. 14, 95-96.

2. Henry de Ria; William de Colkirk; Roger de Kentswell; the bishop of London; Robert de Valognes; Alban de Heron; Walter II de Bolbec; Richard fitz Nigel; Gilbert de Bolbec; William de Serintone; Robert d’Aubigny; Bernard de Bailliol; Robert de Caro; William fitz Aluric; Walter fitz William; Richard Bertram; Gilbert de Boolun; Radulf de Worcester; Arnulf de Moirewick; John fitz Odard; Walter de Aincourt; Richard de Hay; Reginald de Crevequer; Amphrey de Chauncy; Simon de Chauncy; the abbess of Wilton; Richard de Grimstead; Robert de Pont de I’Arche; Henry Lovell; Henry de Cuture; Bernard Pulien; the abbot of Sherborne; the abbot of Cerne; the abbot of Middleton; the abbot of Abbotsbury; Walkelin Hareng; Oliver de Linquir; Philip de Hampton; the abbot of Tavistock; William fitz Reginald; Radulf de Vautort; Robert fitz Geoffrey; William d’Aubigny Brito; Hubert fitz Radulf; Radulf Hanselin; Robert de Caux; Roger de Burun; Robert de Cioches; William de Ros: PR 11 Henry II, passim. For the servitia debita, see Keefe, Feudal Assessments, app. II, pp. 157-88.

3. PR 11 Henry II, p. 19.

4. Richard de Raimes; William Martel; the bishop of Durham; William Trussebut; William Fossard; Randulf fitz Walter; Gerard Giffard; William de Briouze; the honor of Tickhill; Robert Foliot; Baderun de Monmouth; the archbishopric of Canterbury: ibid., pp. 20, 38, 50, 59, 80, 88, 96, 101, 109; Keefe, Feudal Assessments, app. II, pp. 157-88. Only in the cases of Tickhill and the archbishopric of Canterbury can the difference be explained by the fact that honors were in royal custody.

5. PR 11 Henry 11, p. 109; Keefe, Feudal Assessments, p. 157 and n. A second exercitus is also mentioned on the Pipe Rolls in the entry relating to the honor of Walter Giffard, earl of Buckingham (d. 1164), in royal custody in 1165. The custodian, Geoffrey fitz William, accounted for £29 de militibus, that is, 43 1/2 marks, but he also accounted for 8 marks de secundo exercitu: PR 11 Henry II, p. 25. Neither of these figures represents a likely servitium debitum and the total enfeoffment of the honor was 96 knights’ fees: Keefe, Feudal Assessments, p. 173 and n. The extremely small assessment de secundo exercitu is difficult to explain and the entire entry is something of a puzzle. For the question of multiple exercitus connected with this campaign, cf. above p. 532.

6. Round, Feudal England, p. 283.

7. See, for example, PR I1 Henry II, pp. 8, 13, 37, 58, 66, 70, 80, 105.

8. Round, Feudal England, pp. 282-83.

9. PR 8 Henry II, p. 53.

10. PR 9 Henry II, p. 69.

11. PR 13 Henry II, p. 208.

12. PR 14 Henry II, p. 124.

13. PR 12 Henry II, p. 84.

14. PR 11 Henry II, p. 49.

15. T. K. Keefe, ‘The 1165 Levy for the Army of Wales’, Notes and Queries, CCXXVII (1982), 194‑95.

16. PR 11 Henry II, p. 7.

17. ‘Whatever the reason, both rates were roughly calculated to support knights and/or serjeants only, for a lengthy campaign in Wales, perhaps as long as three months.’: Keefe, ‘The 1165 Levy’, p. 195.

18. 600 x 7s. 7d. = £227 10s. Keefe also identifies a third unit of assessment – 15s. 2 Zd. The bishop of Norwich accounted for £76 Os. l0d. , which amounts to 100 of these units. Keefe links with this entry the assessment of the count of Eu, who accounts for £ 152 0s. 10d., although this does not represent an exact multiple of any of the units of assessment, for example, 200 x 15s. 2½d. = £152 1s. 8d.: Keefe, ‘The 1165 Levy’, p. 195; PR 11 Henry II, pp. 7, 92. There are two plausible explanations for the ‘15s. 2½d. unit’ in the case of the bishop’s entry. It could be that the half-year was reckoned precisely – 365/2 = 182½ = 15s. 2½d. Alternatively, the unit may have been, not 15s. 2½d., but £ 1 10s. 5d. , as pay for a whole year (50 x 365 = £76 0s. 10d.). In 1166-67, Walter Coterellus, Durand de Rothomagense, Hugo Scin’, Hosannah Contrevent, and a porter were each paid £ 1 10s. 5d. from the farm of Herefordshire: PR 12 Henry II, p. 69.

19. Keefe, ‘The 1165 Levy’, p. 195.

20. PR II Henry H, p. 13.

21. For a recent discussion concerning periods of knight-service and the pay of knights in relation to scutage, see Keefe, Feudal Assessments, pp. 37‑40. The daily rate of pay attributed to milites certainly did vary in the 1160s. In 1161-62 the pay on one occasion for 7 milites de toto anno was £84 18s. 8d. , which represents 8d. per day for 364 days: PR 8 Henry II, p. 53. In 1163-64 the pay for 9 milites and 4 serjeants at Walton and Dover for the period of 170 days amounted to £28 6s. 8d. Assuming that the serjeants’ pay was Id. per day, then the pay of the milites would have been 4d. per day: PR 10 Henry II, p. 46. In 1164-65 live milites at Dover were paid £25 for 150 days – 8d. per day – but the pay for 60 milites and 300 serjeants with Earl Reginald of Cornwall for 43 days amounted to £182 15s. 0d.: PR 11 Henry II, p. 2. This last entry permits two possible interpretations. Either the pay of the milites was 12d. per day and the serjeants’ pay 1d. per day, or the pay of the milites was 7d. per day and the serjeants’ pay 2d. per day. The latter possibility indicates that we should not take it for granted that serjeants were always paid at the 1d. per day rate.

22. PR 11 Henry II, p. 20. An interesting deduction from this honor’s account was of 5 marks to Stephen de Beauchamp de servientibus quos reddet alibi. In his own right, Stephen de Beauchamp proffered £7 12s. 6d. (10 x 15s. 3d): ibid. Apparently, he was excused his obligations as a sub-tenant of the honor of Peverel of London because of his proffer for serjeants on his tenancy-in-chief.

23. PR 11 Henry II, p. 33.

24. Ibid., p. 109. The variation in the treatment of actual service by knights of these honors is interesting. It may represent a transitional stage in the tendency towards proper support of contingents less than theservitium debitum of the king’s tenants-in-chief: see Keefe, Feudal Assessments, p. 40.

25. PR 11 Henry II, p. 53.

26. Ibid., p. 80.

27. Ibid., p. 66. In some cases, the sub-tenants whose scutage was pardoned recur under more than one honor. For example, Robert fitz Bernard (ibid., pp. 13, 80); William Malet (ibid., pp. 42(2), (109); Robert Bucherel (ibid., 42, 66(2)); Henry fitz William fitz John (ibid., pp. 42, 66, 81); Richard de Camville (ibid., pp. 49, 83); William de Hastings (ibid., p. 83(3)). This reinforces the idea that the scutage of these sub-tenants was excused because of their personal service.

28. Ibid., pp. 71, 75.

29. This is based on the total enfeoffments of these tenancies. Servitia debita were in most cases less than the total enfeoffments. The average of 3.57 is an arithmetic mean from a highly variable set of figures standard deviation 3.61.

30. Round noticed that there were several examples of tenancies of one knight’s fee charged for five serjeants (5 x 15s. 3d.), but correctly stated that there was no fixed relationship between the number of knights’ fees and the number of serjeants proffered: Round, Feudal England, pp. 282-83.

31. The correlation coefficient of the number of knights’ fees (total enfeoffment) in relation to the number of serjeants assessed was 0.83. The bishop of Winchester’s assessment was perhaps an example of this rough and ready equity. He accounted for £228 15s. (200 x 15s. 3d.): PR 11 Henry II, p. 42. This was the highest of all the ecclesiastical assessments, but, as Keefe has suggested, could be justified on the grounds that the bishop was accounting for the abbey of Glastonbury as well as the bishopric: Keefe, Feudal Assessments, pp. 27, 29 and n. 52.

32. PR 11 Henry II, p. 50; Keefe, Feudal assessments, p. 157 and n. 4.

33. PR 18 Henry II, pp. 30, 60; Keefe, Feudal Assessments, p. 29.

34. Even if only the principal baronial honors in Wales are considered – Abergavenny, Brecknock, Cardigan, Gower, Gwent, Pembroke and Radnor – the heirs of the earls of Hereford, both comital branches of the Clare family, the earl of Gloucester, the Beaumont earls of Warwick and William de Breouse were all directly concerned. To these one must add Hugh, earl of Chester and all the other barons of the border areas.

This article was originally published in The Welsh Historical Review, v.14 n.4 (1989). We thank Paul Latimer and the University of Wales Press for giving us permission to republish it.